17570

17570

Your Benefits Schemes are how your Benefits are organised within your Mednefits account. Your Benefits Schemes indicate the type of coverage, access, and entitlement amount you have.

Your Benefits Scheme will include:

- Categories: Panel Providers or Non-Panel Providers you have access to.

- Panel Providers: providers that are Mednefits Partners (and can be located within the Mednefits App).

- Non-Panel Providers: all other providers.

- Your Benefits Amount:

- Balance: Your current balance remaining in your account

- Spent: Your usage

- Rollover: Balance from your previous scheme and it allows you to submit your past claim if only your company has enabled it

- Cap per Visit: An amount that is capped on your visit

- (Example: You have a $30 cap per visit. You visit a Mednefits Panel GP and you pay $45 in services and medication. The Mednefits App will automatically deduct $30 from your Benefits Balance. You pay for the remaining $15 via out of pocket).

Here's how you can view your Benefits and Benefits Schemes in the Mednefits App:

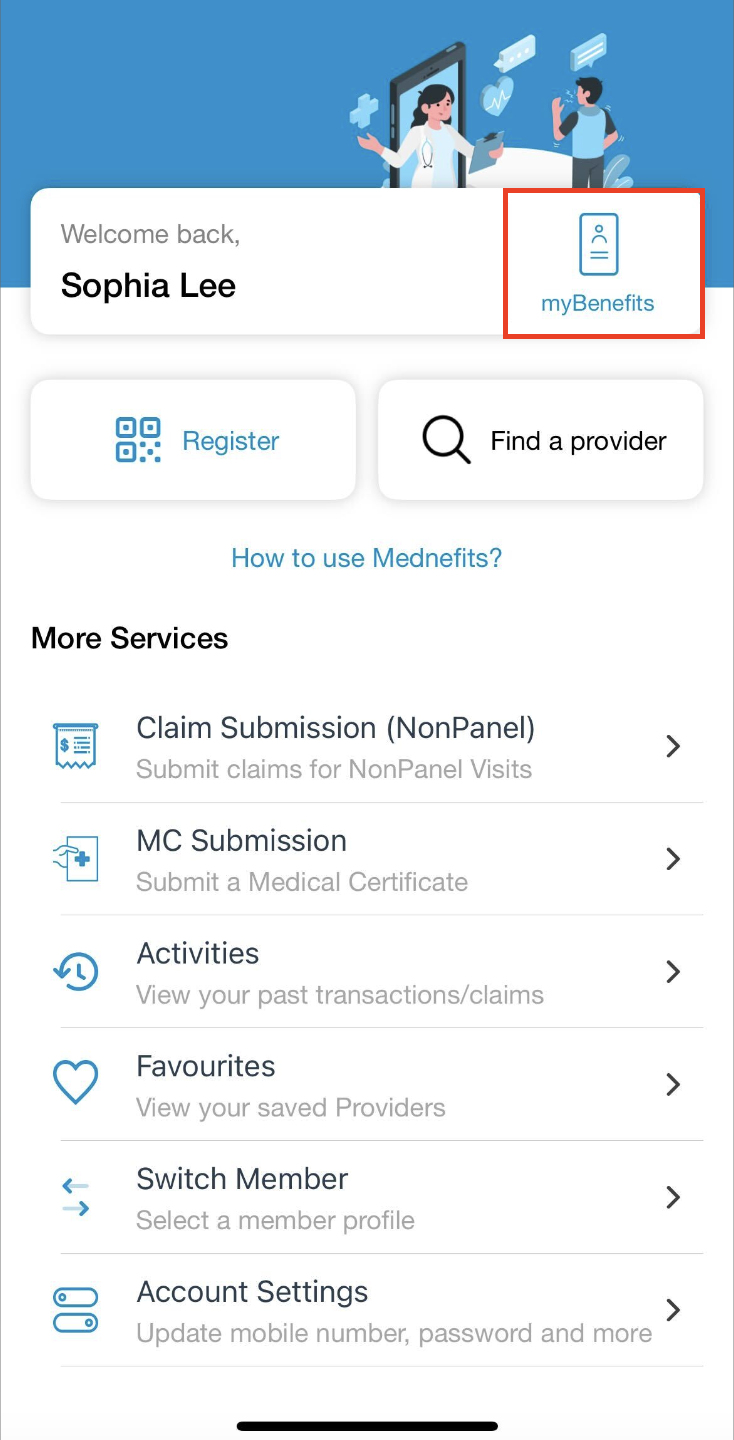

Step 1: On the Mednefits App Homepage, select My Benefits:

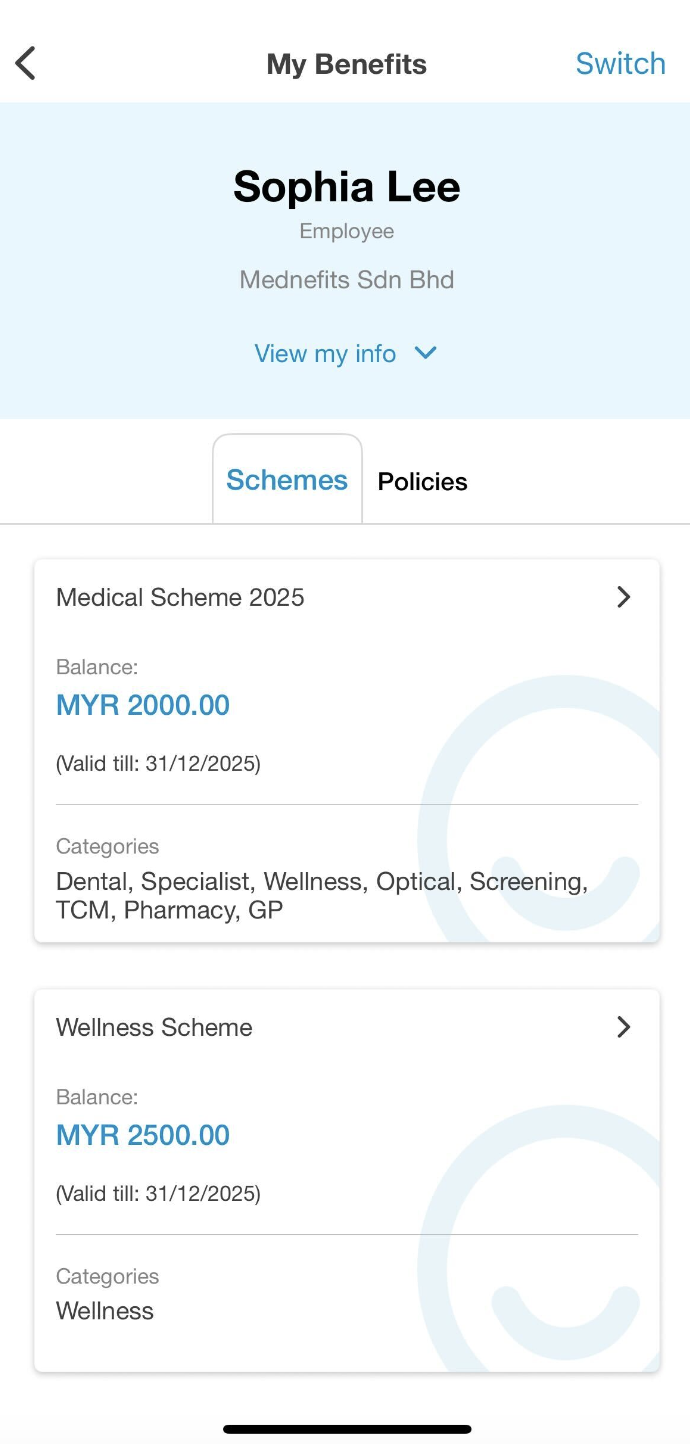

Step 2: Here is where you may view your personal Benefits, or click Switch to see other Dependents (if any) attached to your account. You should have a minimum of 1 Benefits Scheme. Please note that your Benefits Schemes may be titled differently, so click through to see the categories of benefits that apply. (if you have more than 1 Benefits Scheme)

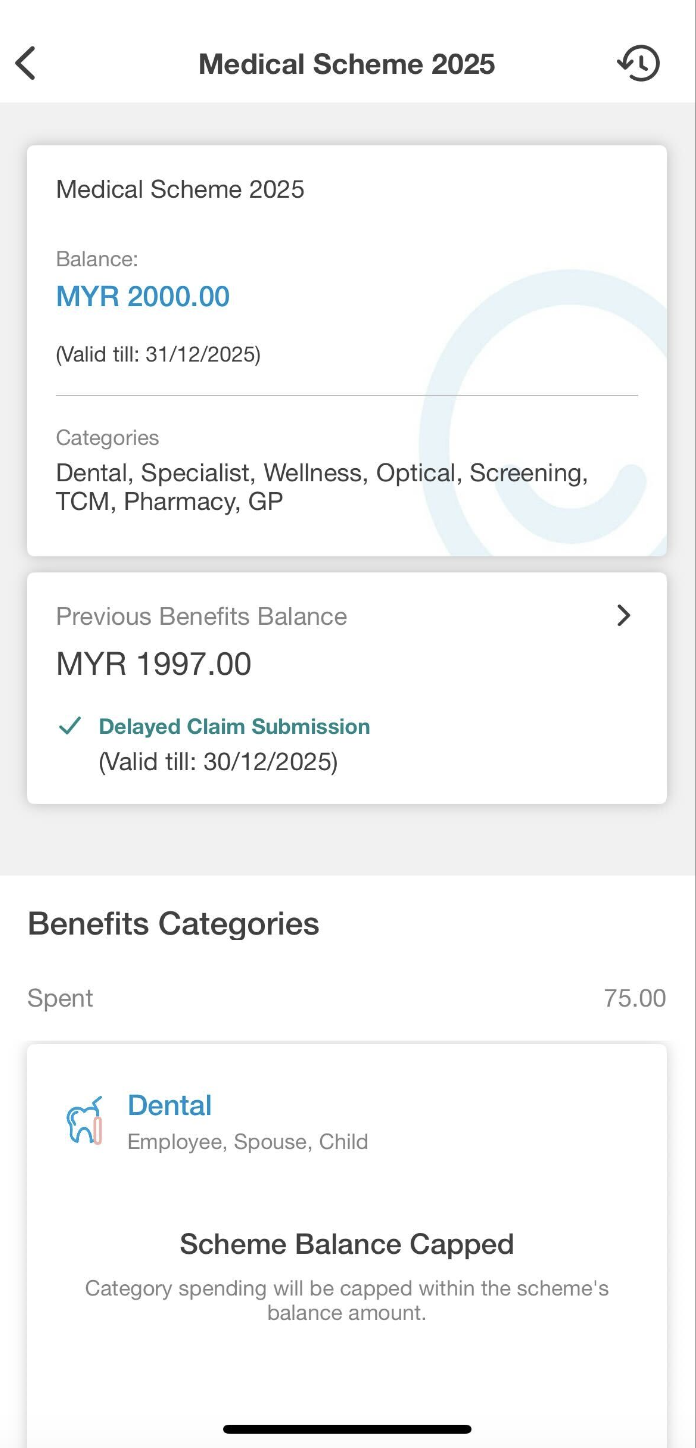

Step 3: Select one of your Benefits Schemes to see more detail.

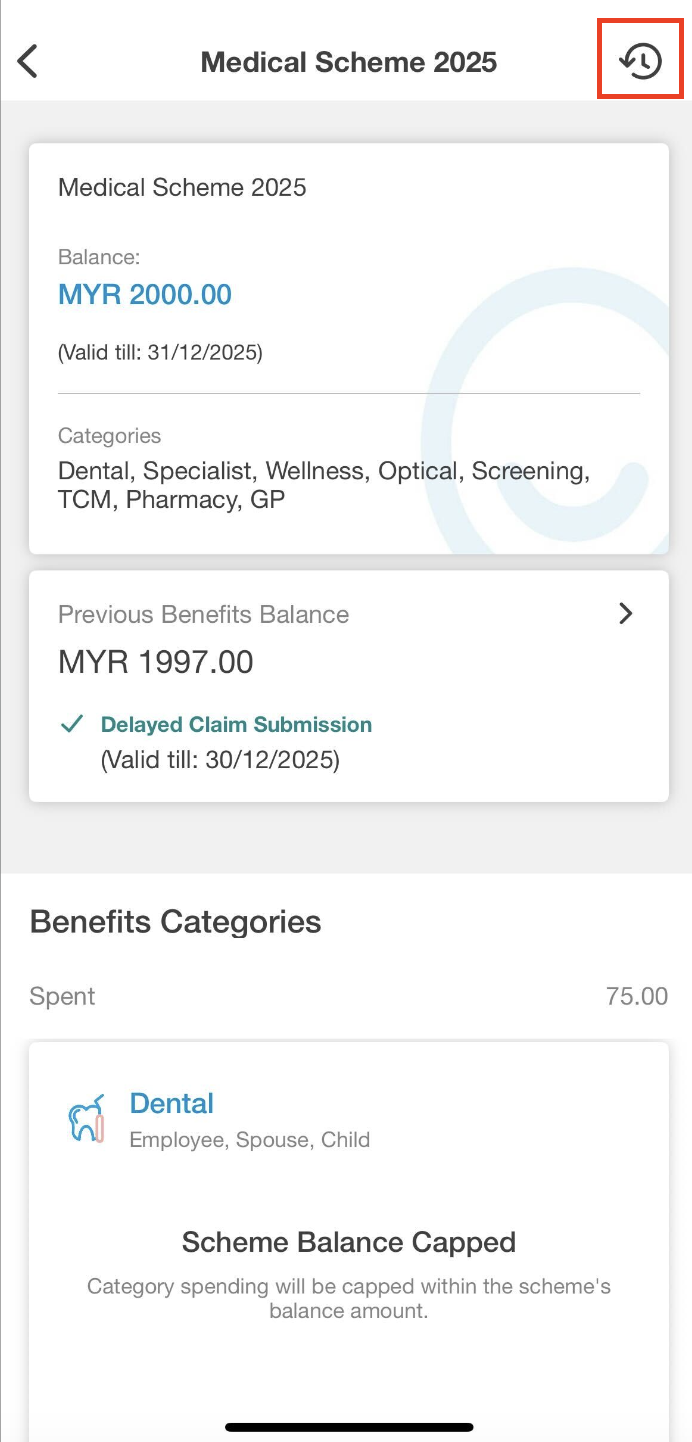

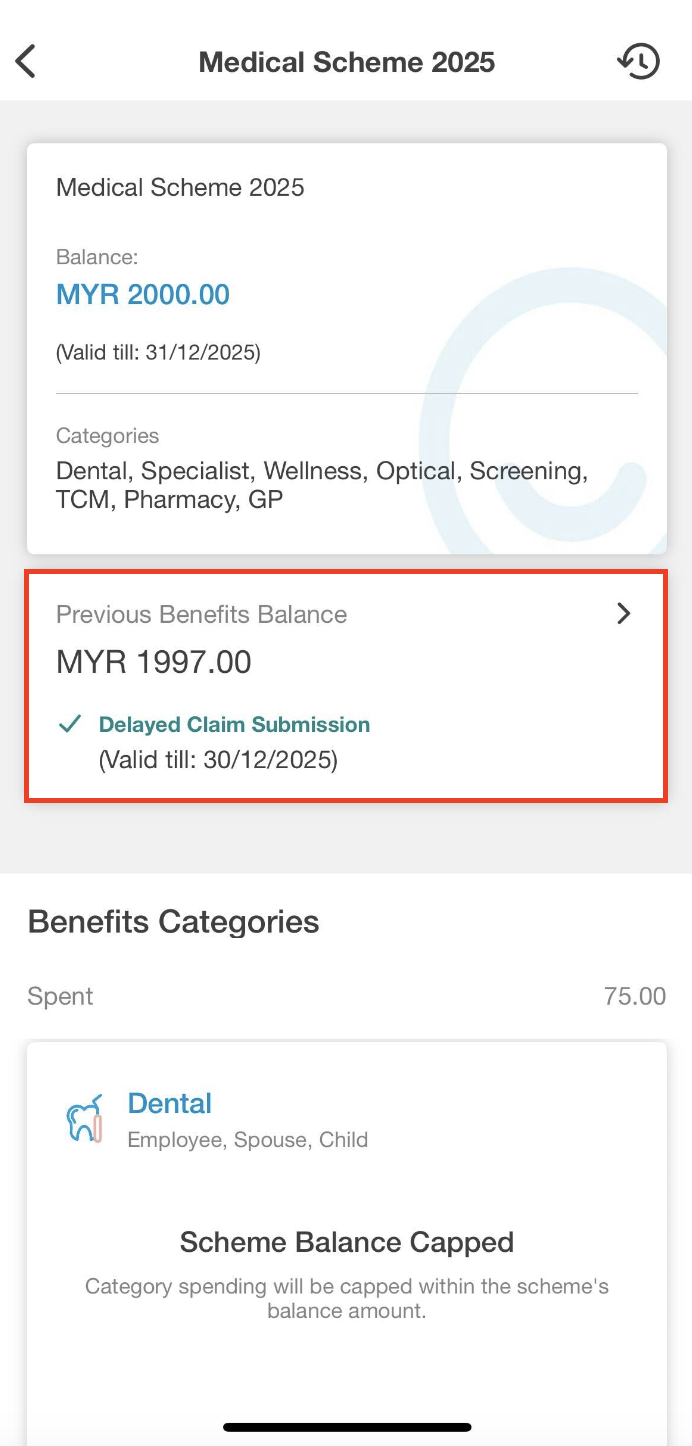

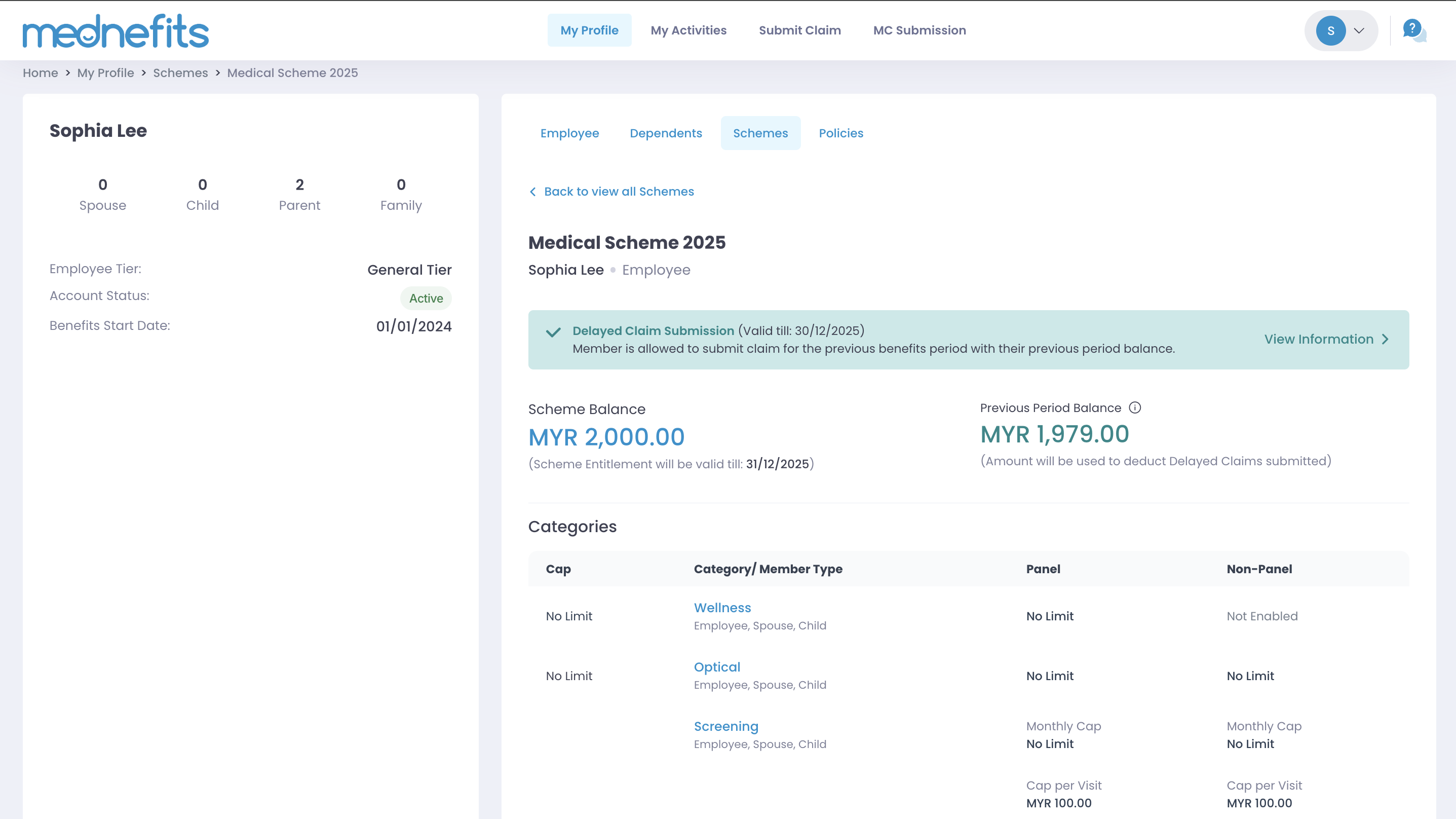

For example, this Benefits Scheme indicates a total annual entitlement of RM2,000 and and balance from Previous Benefits Balance, RM1,997.

The category is for Dental, Specialist, Wellness, Optical, Screening, TCM Pharmacy, and GP.

- The Previous Benefits Balance allow you to submit your past claim, only if your company has enabled it.

- The Previous Benefits Balance indicator will only be shown when the scheme is still within the rollover period and need to be utilized by the respective period.

- The balance can only be used for Panel Transactions/ Non-Panel Claims from the Current/New Benefits Period.

NEW! You may now view the details of the coverage available under each category. Please refer to this description to better understand your company's policy and important points to take note of.

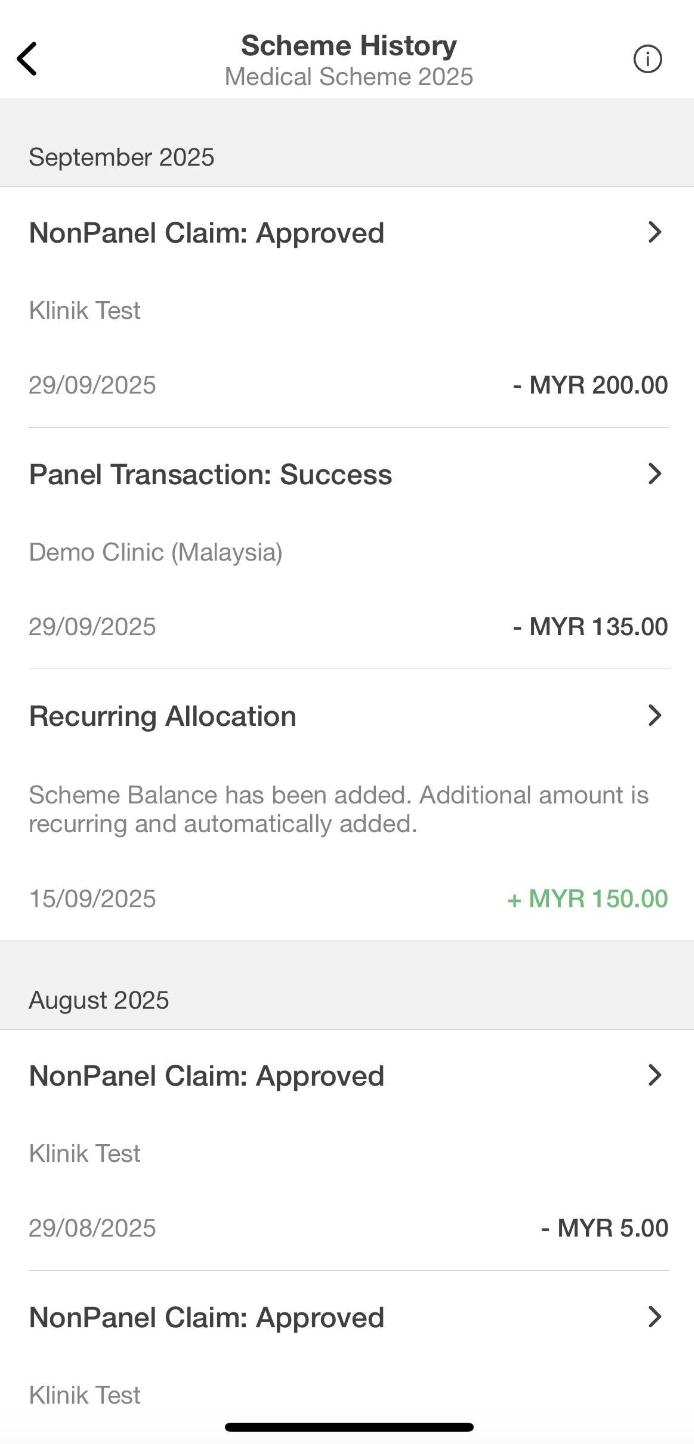

Step 4: You may also view the scheme history by selecting the icon below located at the top right of the page.

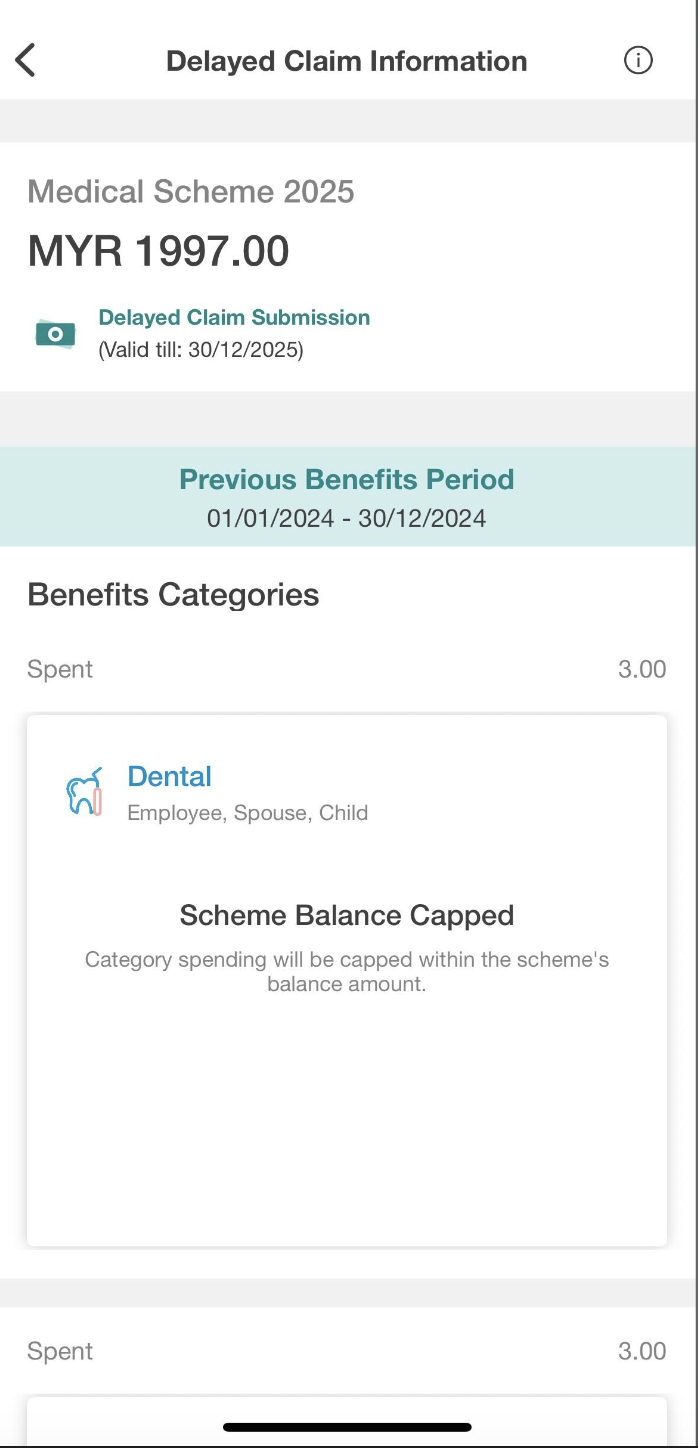

Step 5: If your Benefits Scheme has a Previous Benefits Balance with Delayed Claim Submission, you may click on it to know more.

- Delayed Claim Submission allows you to submit claims for the previous benefits period. Delayed claims are capped accordingly to the previous benefits period and deducted from the rollover balance.

Important Notes

- If the receipt amount you have entered exceeds the remaining amount in your account, your claim amount will be revised down to the amount remaining in your account.

- Example: Jenny has $20 remaining in her account. She files a claim with a receipt amount of $30. The claim amount will be $20.

- If your claim’s visit date falls in your company’s previous term, the claim amount will be deducted from your account balance in the previous term.

- Example 1: On 31 December, James has $50. That day, he falls ill and visits a non-panel clinic, where he pays $30 out of pocket. On 1 January, his credits are reset to $500. On 2 January, James files a claim for his 31 December visit. His claim is approved. $30 will be deducted from his previous term balance of $50. His current term balance will remain $500.

- Example 2: On 31 December, John has $20. That day, he falls ill and visits a non-panel clinic, where he pays $30 out of pocket. On 1 January, his credits are reset to $500. On 2 January, James files a claim for his 31 December visit. His claim is approved. $20 will be deducted from his previous term balance of $20. His current term balance will remain $500.

Alternatively, your Benefits may look like the following, where there are a number of visits displayed instead (pictured below). This example shows that you have a balance of 18 remaining visits.

Alternatively, you can view your Benefits and Benefits Schemes via the member portal:

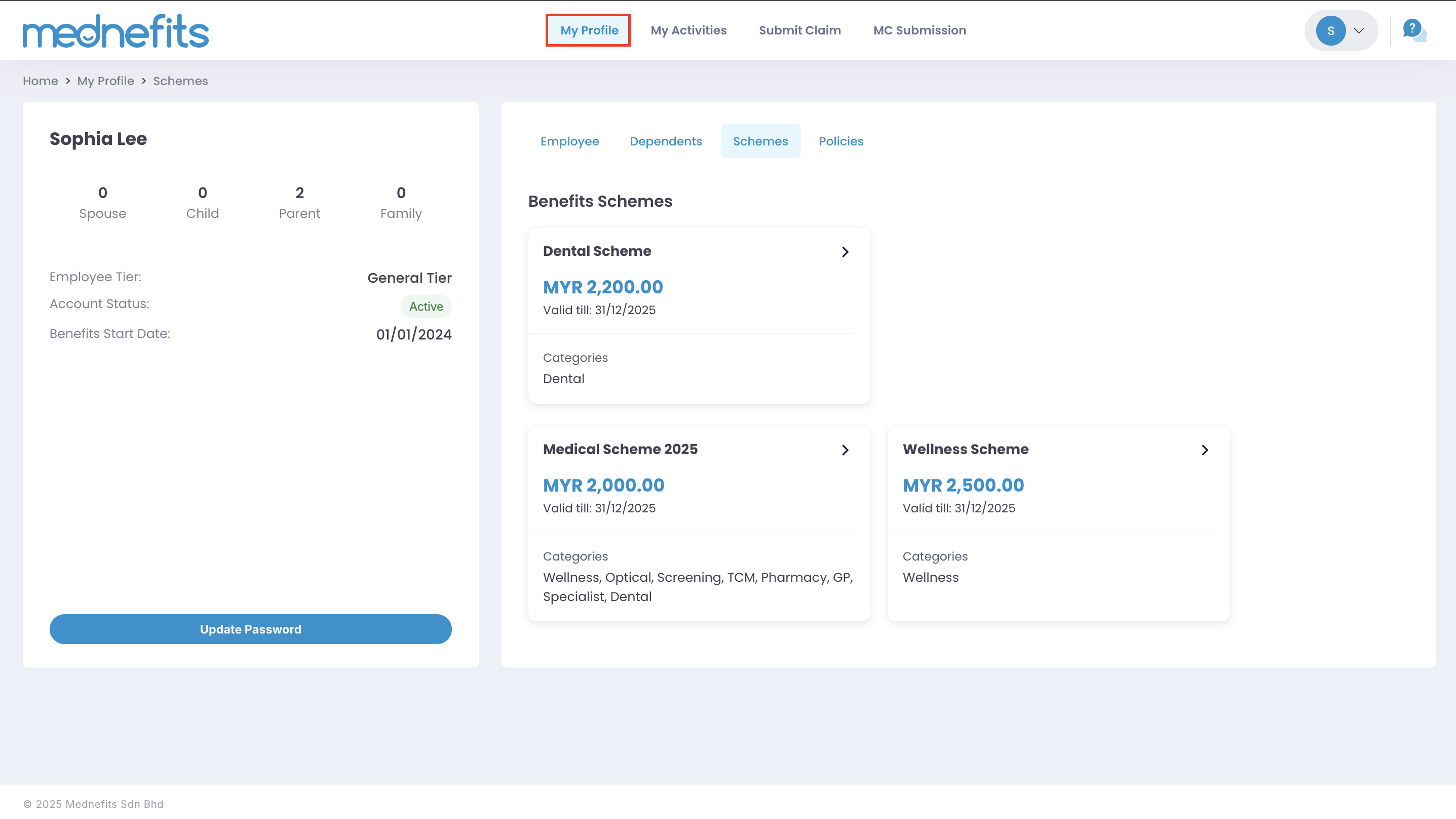

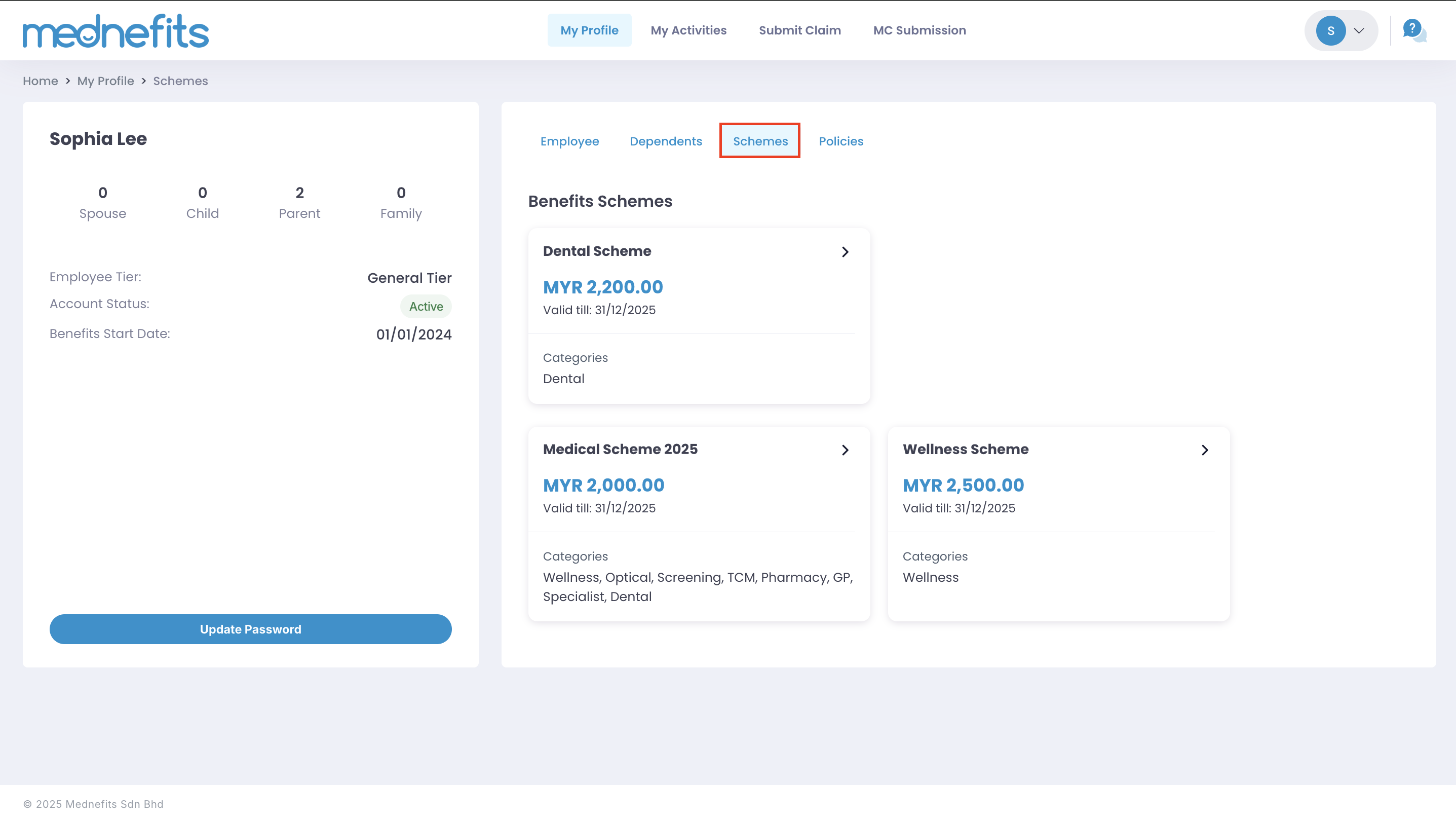

Step 1: Click on My Profile then click on Schemes to view the available schemes.

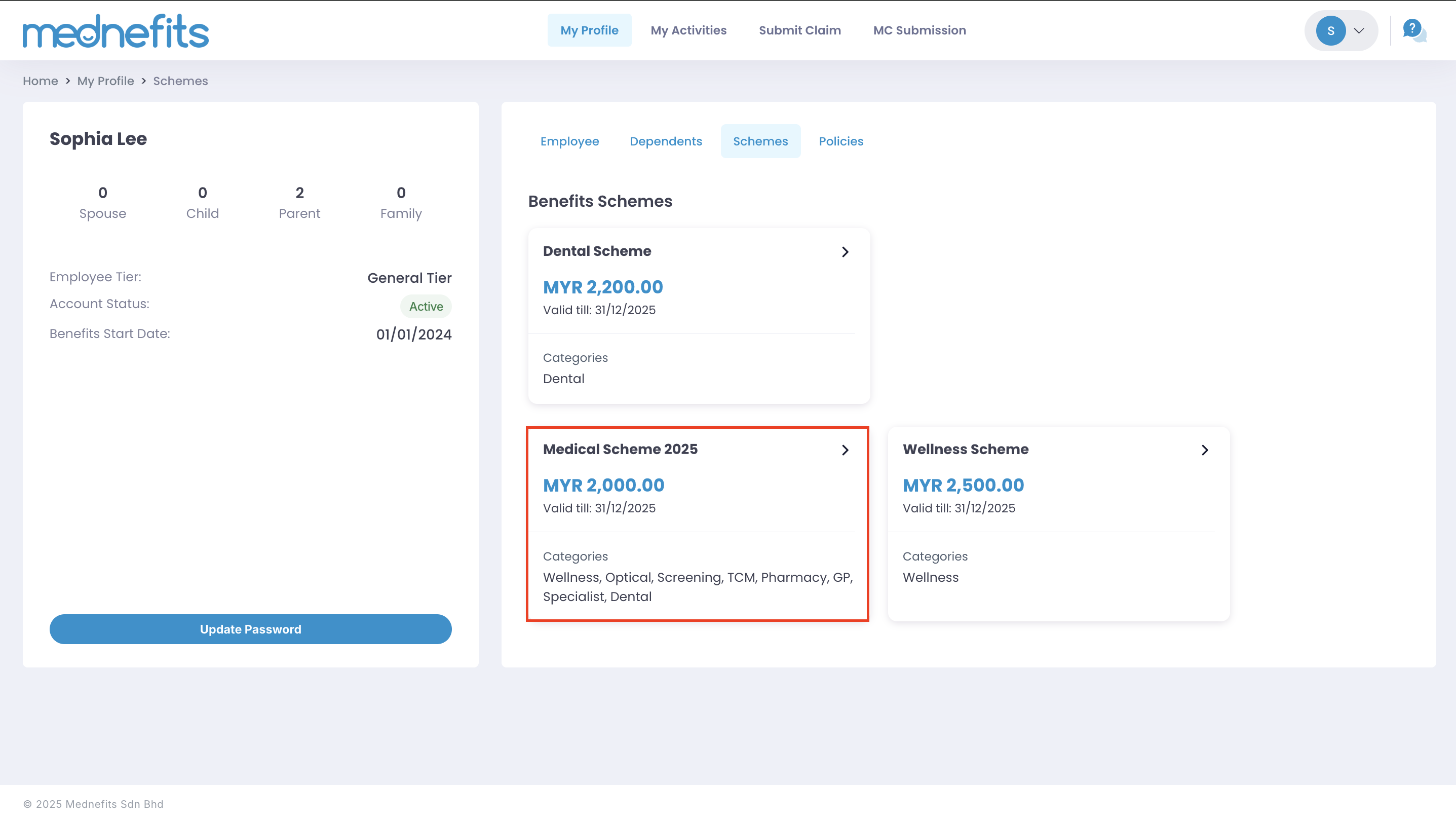

Step 2: Click on the scheme you wish to check.

Step 3: You may view the full details of the coverage available under the scheme. You may also view if there is any Delayed Claim Submission available that allows you to submit claims for the previous benefits period.

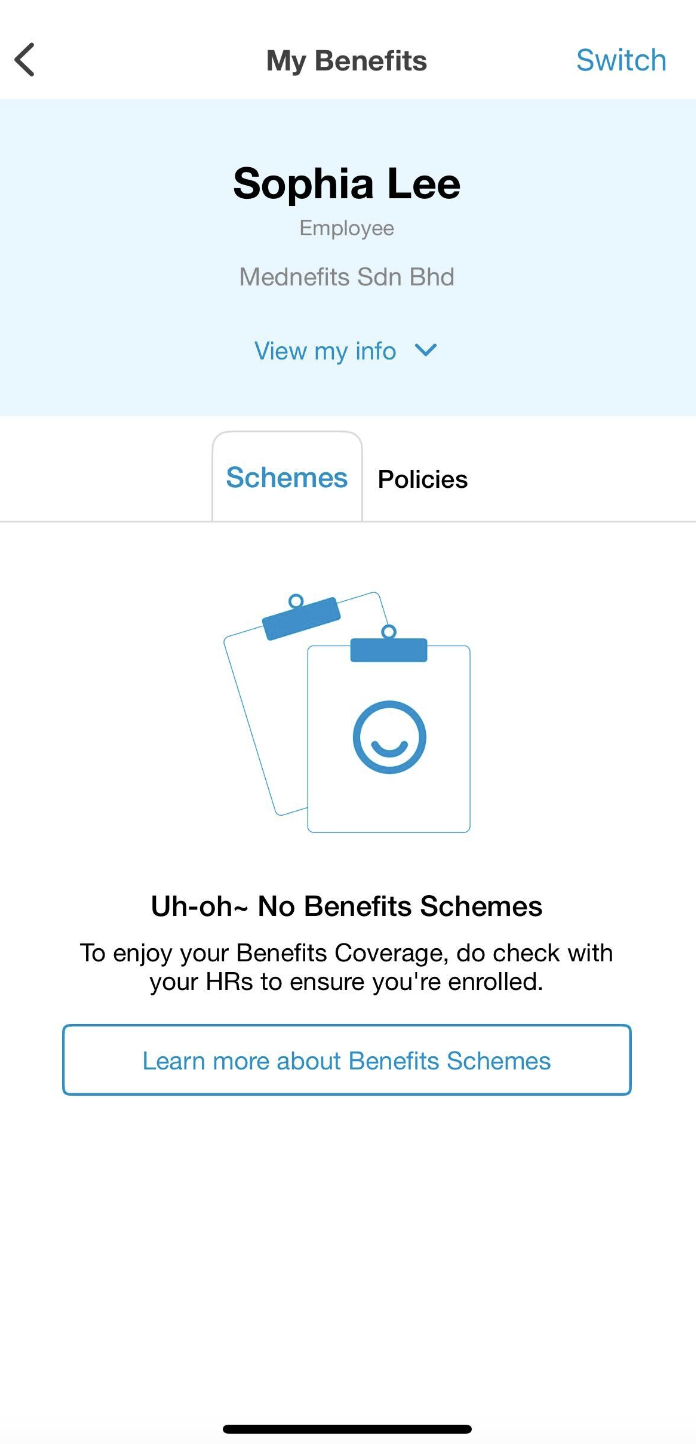

Uh oh! If you don't see any Benefits Schemes tied to your account, please reach out to your company HR directly.